Table of Contents

- Introduction

- Understanding Market Participants and Their Roles

- Market Participants in Different Financial Markets

- Market Dynamics and Influences

- How Market Participants Interact

- Regulatory Participants in the US Financial Market

- Buy-Side vs. Sell-Side Market Participants

- Detailed Breakdown of Liquidity Providers

- Examples of Liquidity Providers and Their Roles

- How Liquidity Providers Impact Market Volatility

- Broker-Dealer vs. Market Maker

- How Buy-Side and Sell-Side Firms Make Profits

- FAQs About Market Participants

- Conclusion

Introduction to Market Participants

Market participants play a pivotal role in the financial markets, acting as the backbone of trading activities. They include individual traders, large institutional investors, brokers, and market makers, each contributing uniquely to the overall market dynamics. Understanding who these players are and how they interact is essential for anyone looking to invest or trade. This article explores various types of participants and their impact on different financial markets like the stock market, foreign exchange (forex) market, and bond market.

Understanding Market Participants and Their Roles

Who Are Market Participants?

Market participants are the people and institutions actively involved in the buying and selling of financial assets. They can be categorized into three main groups:

- Buyers: Individuals or entities purchasing assets in anticipation of price appreciation.

- Sellers: Individuals or entities selling assets, often to realize gains or cut losses.

- Intermediaries: Market makers and brokers who facilitate transactions, ensuring smooth functioning of the markets.

Some market participants, like institutional investors, can have a significant impact on the overall market due to their large capital and high-volume trades. They are often seen as trend-setters in financial markets.

These participants create a balanced environment of supply and demand, impacting overall market prices and trends.

| Type | Description | Market Impact |

|---|---|---|

| Retail Investors | Individual investors who trade with their own money. | Low impact due to limited capital. |

| Institutional Investors | Organizations like mutual funds, pension funds, with large capital. | High impact; influence prices and trends. |

| Market Makers | Firms ensuring liquidity by buying/selling at their quoted prices. | Maintain liquidity; set bid/ask spreads. |

| Brokers | Agents who facilitate trading between buyers and sellers. | Enable smooth market functioning. |

Types of Market Participants in Financial Markets

Market participants can be classified into four main categories:

- Retail Investors: Individual investors trading with their personal capital.

- Institutional Investors: Large entities like mutual funds, pension funds, and hedge funds with significant financial influence.

- Market Makers: Firms providing liquidity by continuously buying and selling at quoted prices.

- Brokers: Agents facilitating trades between buyers and sellers.

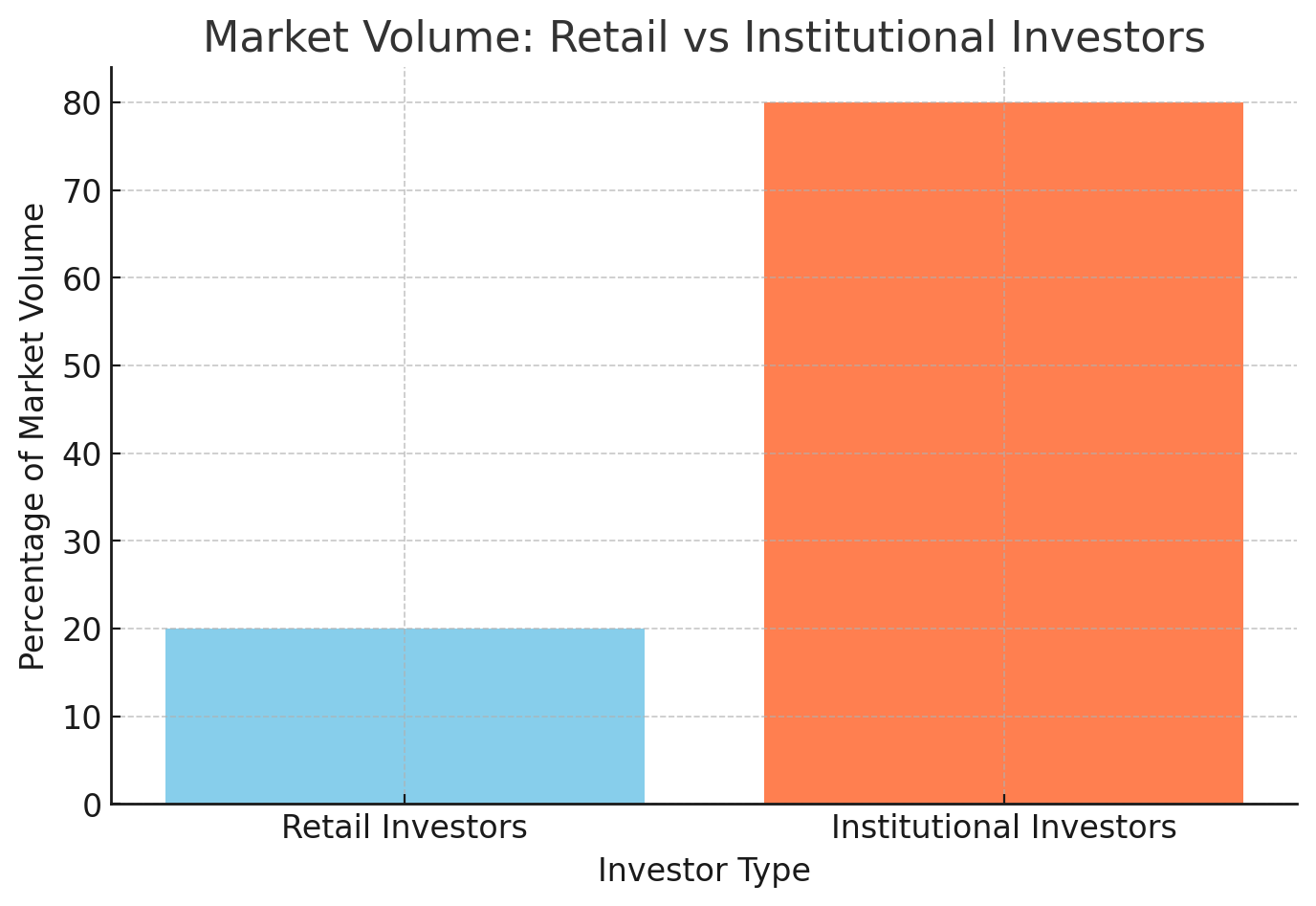

Did you know? Institutional investors manage over 80% of all stock market volume in the US, making them key drivers of market trends and price movements.

Retail vs. Institutional Investors: Differences in Strategy and Market Influence

Retail investors and institutional investors differ significantly in their strategies and market impact:

- Retail Investors: Often trade small amounts, primarily driven by short-term goals.

- Institutional Investors: Have large capital reserves and can influence entire market trends with single trades.

Market Volume: Retail vs Institutional Investors

The chart shows the significant difference in market volume between Retail and Institutional Investors, with Institutional Investors dominating the market.

For example, an institutional investor like a hedge fund can buy a large block of shares in one transaction, causing a sudden spike in the stock price that can ripple across the market.

The Role of Market Makers and Brokers

Market makers and brokers are essential intermediaries who facilitate trades:

- Market Makers: Set bid and ask prices, ensuring there is always a buyer or seller.

- Brokers: Execute trades on behalf of clients, providing advice and services for a fee.

Because market makers are required to buy and sell securities at all times, they ensure that even during volatile times, there’s always a price available for investors looking to buy or sell.

These entities maintain liquidity and stability, making it easier for other participants to trade.

Market Participants in Different Financial Markets

Understanding Forex Market Participants

The foreign exchange (forex) market operates 24 hours a day and involves a wide variety of participants:

- Central Banks: The most powerful entities, controlling national currencies and monetary policies.

- Commercial Banks: Major players influencing exchange rates through large transactions.

- Multinational Corporations: Engage in forex trading to hedge their international operations.

- Individual Traders: Smaller players who speculate on currency movements.

In the forex market, central banks play a pivotal role as they intervene to stabilize or devalue their currency, impacting the global economy.

Bond Market Participants and Their Role

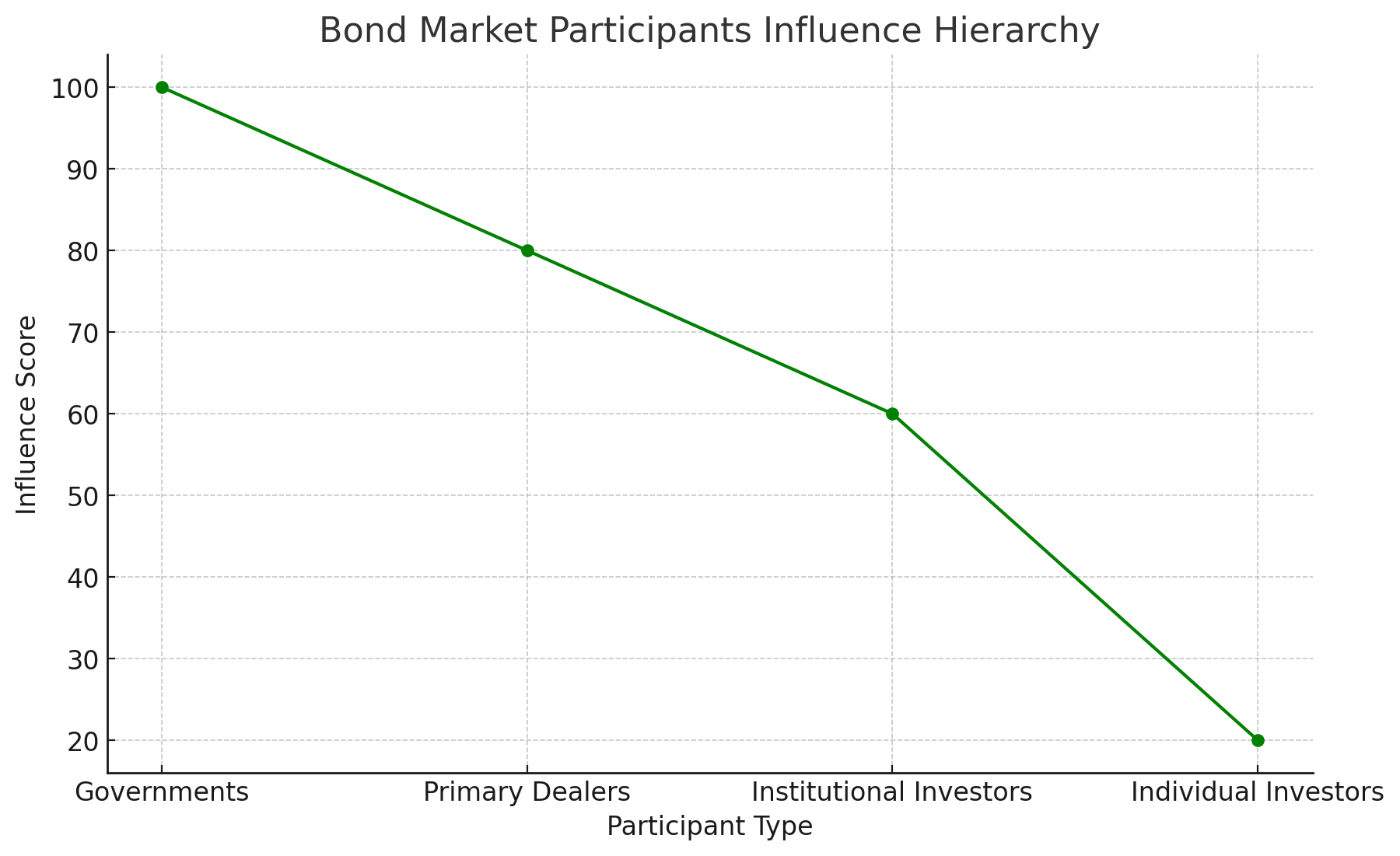

The bond market is dominated by large institutions and governments. Key participants include:

- Governments: The largest issuers of bonds to finance public projects.

- Primary Dealers: Financial firms authorized to trade directly with the Federal Reserve.

- Institutional Investors: Pension funds and insurance companies that buy bonds for long-term returns.

- Individual Investors: Small players participating in municipal and corporate bonds.

Bond Market Participants Influence Hierarchy

This hierarchy chart illustrates the varying levels of influence each participant has in the bond market, with Governments having the highest impact, followed by Primary Dealers, Institutional Investors, and Individual Investors.

Governments are the biggest players in the bond market, issuing trillions of dollars in bonds annually to finance infrastructure and public services.

Commodity Market Participants: Buyers, Producers, and Speculators

Commodity markets, like oil and gold, involve three main groups:

- Producers: Companies or entities that extract, grow, or harvest commodities.

- Commercial Buyers: Businesses that buy commodities to use in production or as raw materials.

- Speculators: Traders who buy and sell to profit from price changes, without intending to own the physical commodities.

Their actions directly influence commodity prices, making them critical players in the commodity market.

Global Perspective: How Market Participants Vary Across International Markets

The role of market participants varies significantly in different global markets:

- United States: Highly regulated with a focus on transparency and investor protection.

- Europe: Similar structure but includes more cross-border participants due to the EU’s integrated markets.

- Asia: Heavy government influence, particularly in China, where state-owned enterprises play a major role.

Asian markets, such as Japan and China, are influenced heavily by government regulations, making them more volatile compared to Western markets.

A deeper understanding of these variations is essential for international investors looking to diversify their portfolios.

—

Market Dynamics and Influences

How Market Sentiment Shapes Market Movements

Market sentiment refers to the overall attitude of investors toward a particular market or asset. It often determines short-term price movements:

- Positive Sentiment: When investors are optimistic, prices typically rise, leading to a bullish market.

- Negative Sentiment: When fear dominates, prices fall, creating a bearish environment.

Market sentiment can sometimes override fundamental analysis, leading to overvalued or undervalued assets based on the collective mood of participants.

Risk Management Strategies Used by Market Participants

Different participants employ various risk management strategies to minimize potential losses:

- Hedging: Used by institutional investors to lock in prices and reduce volatility.

- Stop-Loss Orders: Common among retail investors to limit downside risks.

- Diversification: Spreading investments across different asset classes to reduce risk.

Remember, diversification is often called the “only free lunch” in finance because it reduces risk without sacrificing potential returns.

The Impact of Technology on Market Participants

Technological advancements have significantly transformed market dynamics:

- Algorithmic Trading: Uses computer programs to execute trades at high speed.

- Robo-Advisors: Offer automated, low-cost investment management for retail investors.

- High-Frequency Trading: Institutions use algorithms to gain a fraction-of-a-second advantage over competitors.

For example, high-frequency trading now accounts for nearly 70% of all trades in the US equity market, reshaping the speed and volatility of the markets.

—

How Market Participants Interact

How Market Participants Interact with Each Other

The interactions between buyers, sellers, and intermediaries are what drive market movements. Here’s how it works:

- Buyers and Sellers: The primary participants, creating the supply and demand.

- Intermediaries (Market Makers, Brokers): Facilitate trades, providing liquidity.

When large institutional buyers enter the market, they often look for intermediaries who can absorb their large trades without drastically moving the market price.

These interactions determine asset prices and trading volumes.

The Influence of Institutional Investors on Market Dynamics

Institutional investors, such as pension funds and hedge funds, can manipulate entire market sectors. For instance, a hedge fund’s decision to buy a large quantity of a particular stock can significantly increase its price, impacting smaller participants.

One famous example is the “London Whale,” where a trader at JPMorgan Chase placed massive bets on credit derivatives, causing huge price swings and losses of over $6 billion.

The Role of Retail Investors in Financial Markets

Retail investors, though smaller, have become more influential in recent years due to social media and online trading platforms. Events like the GameStop saga highlight the growing power of retail investors to move markets collectively.

Social media platforms like Reddit have empowered retail investors, allowing them to coordinate trades and compete against institutional giants.

Regulatory Participants in the US Financial Market

In addition to traditional market participants, the US financial market has several regulatory entities that ensure smooth functioning and compliance:

- Broker-Dealers: Execute trades on behalf of clients and provide liquidity.

- Clearing Agencies: Handle trade settlement and mitigate counterparty risk.

- Self-Regulatory Organizations (SROs): Oversee compliance, such as FINRA and exchanges like NYSE.

- Credit Rating Agencies: Assess the creditworthiness of issuers and influence bond market pricing.

- Alternative Trading Systems (ATS): Provide trading platforms outside of traditional exchanges.

- Transfer Agents: Maintain records of investor ownership and manage securities transfers.

Buy-Side vs. Sell-Side Market Participants

The buy-side and sell-side are two main categories of market participants that differ significantly in their roles and objectives:

| Category | Description |

|---|---|

| Buy-Side | Includes entities like asset managers, hedge funds, and institutional investors. Their goal is to buy securities and assets to generate returns for their clients through investment strategies. |

| Sell-Side | Consists of broker-dealers, investment banks, and market makers. They facilitate trades, provide liquidity, and offer research and advisory services to the buy-side participants. |

Detailed Breakdown of Liquidity Providers

Liquidity providers are crucial for maintaining smooth market operations by offering consistent buy and sell prices. They help reduce volatility and ensure efficient trading. Here’s a breakdown of different types:

- Market Makers: Continuously provide buy and sell prices, ensuring that trades can be executed at any time, thereby reducing volatility.

- High-Frequency Traders (HFTs): Use sophisticated algorithms to add liquidity by exploiting tiny price inefficiencies.

- Proprietary Trading Firms: Trade with their own capital, often in large volumes, providing liquidity and stabilizing prices.

Examples of Liquidity Providers and Their Roles

Here are some prominent liquidity providers and their roles in the market:

- Citadel Securities: A major market maker providing liquidity in stocks, options, and ETFs, helping maintain efficient pricing.

- Virtu Financial: An HFT firm using algorithms to narrow bid-ask spreads across multiple markets.

- Goldman Sachs: Acts as a market maker in derivatives, facilitating large trades and ensuring minimal price disruption.

How Liquidity Providers Impact Market Volatility

Liquidity providers reduce market volatility by maintaining continuous buy and sell orders. Their presence ensures smoother transactions and prevents large price swings caused by sudden spikes in demand or supply. Without them, markets would experience more drastic price changes, leading to increased volatility and reduced market efficiency.

Broker-Dealer vs. Market Maker

Although broker-dealers and market makers both facilitate trading, they differ in how they operate:

| Participant | Function |

|---|---|

| Broker-Dealer | Executes buy/sell orders on behalf of clients. Brokers charge commissions, while dealers trade securities from their own accounts, earning through spreads. |

| Market Maker | Always provides bid and ask prices, ensuring there’s always a buyer and seller. They profit from the difference (spread) between these prices and maintain liquidity. |

How Buy-Side and Sell-Side Firms Make Profits

- Buy-Side Firms: Make profits through capital appreciation, interest, dividends, and short-term trading gains. Their primary goal is to maximize investment returns for their clients.

- Sell-Side Firms: Earn through commissions, underwriting fees, advisory services, and proprietary trading. They profit by facilitating trades, offering financial products, and providing research and advice.

FAQs About Market Participants

- What is a market participant? A market participant is any individual or institution engaged in buying or selling financial assets.

- How do institutional investors impact the market? Their large-scale trades can influence asset prices, trends, and overall market sentiment.

- What are the major differences between retail and institutional investors? Retail investors have limited capital and primarily focus on small trades, while institutional investors handle large transactions that can shift market trends.

- Why are market makers important? They ensure liquidity, making it easier for buyers and sellers to execute trades.

- What is the role of central banks in the forex market? Central banks control currency supply and demand, directly influencing exchange rates.

Conclusion

Market participants are essential players in the financial markets, influencing price trends, liquidity, and market stability. By understanding the various roles and strategies of these participants, traders and investors can make better-informed decisions. Keeping an eye on the actions of major participants like institutional investors and central banks can provide insights into future market movements.